Deductible Meals In 2025 – The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2025, which could result in a lower tax bill for many Americans. . Mileage or vehicle expenses. Retirement savings. Insurance premiums. Office supplies. Home office expenses. Credit card and loan interest. Phone and internet costs. Business meals. Business .

Deductible Meals In 2025

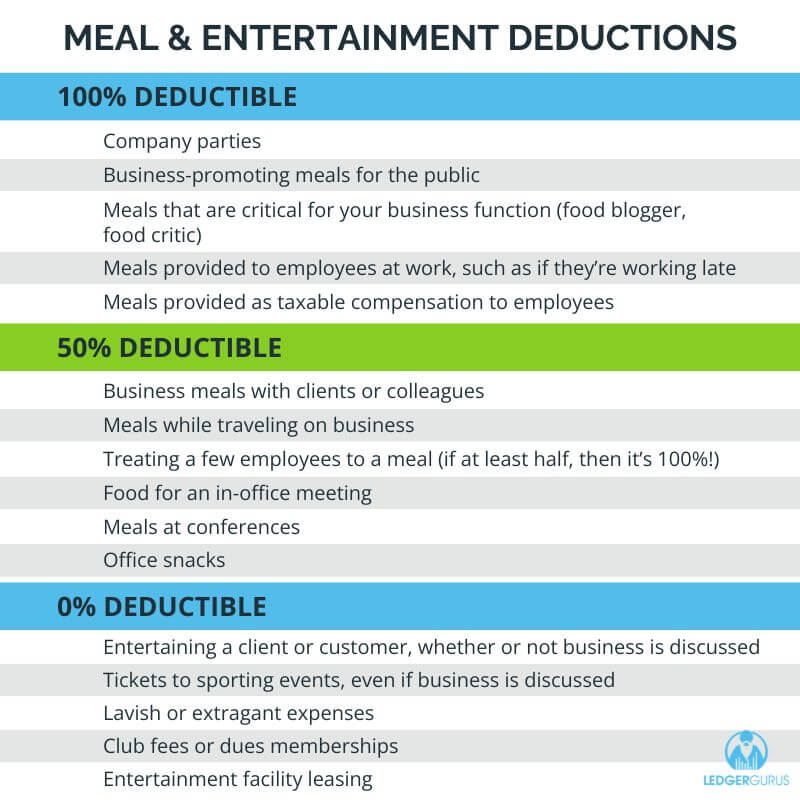

Source : ledgergurus.comHow to Deduct Meals and Entertainment in 2025

Source : www.bench.coMeal and Entertainment Deductions for 2023 2025

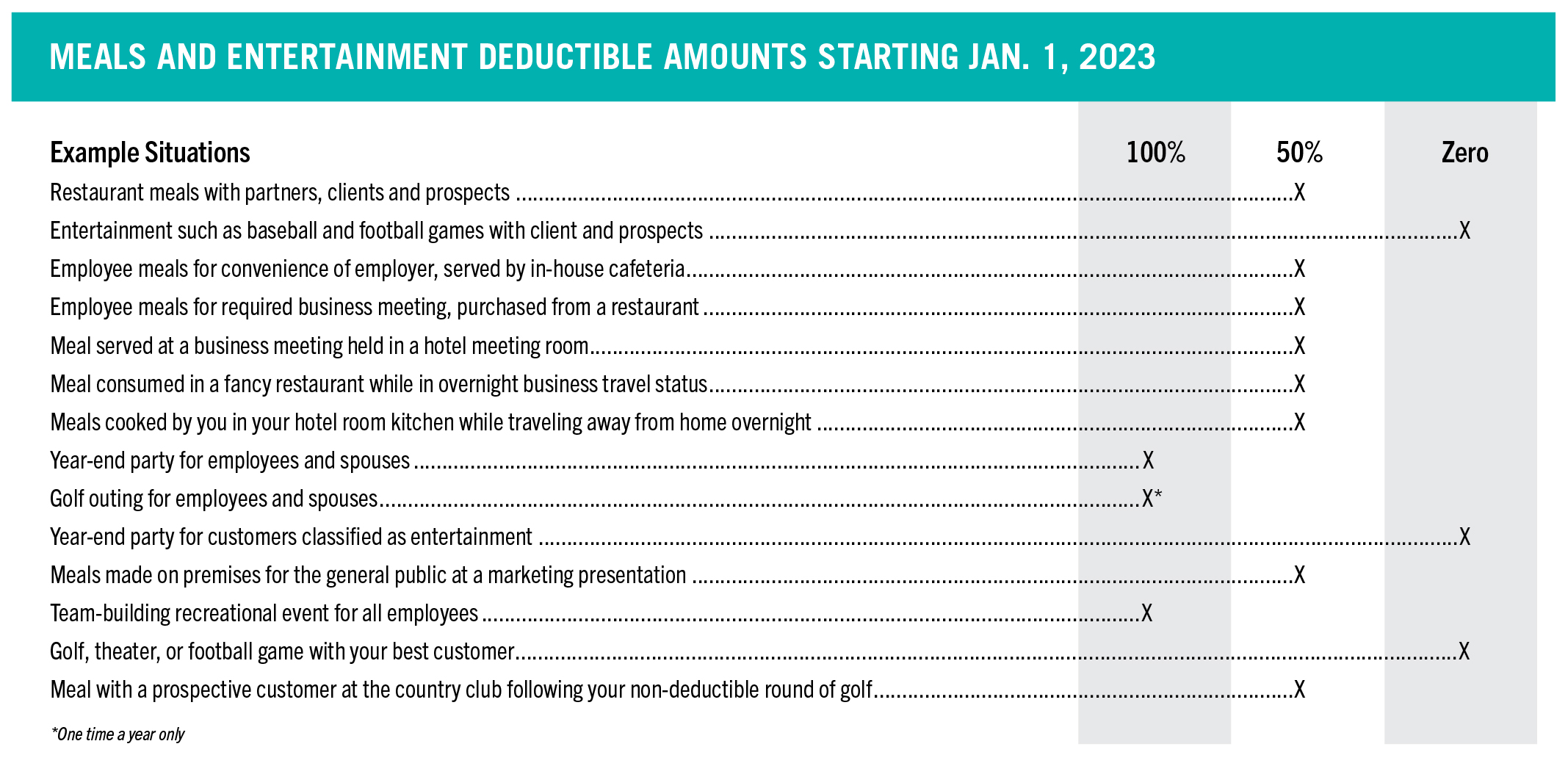

Source : ledgergurus.comMeals & Entertainment Deduction Reverts to Pre TCJA Law AAFCPAs

Source : www.aafcpa.comHow to Deduct Business Meals in 2025: Ultimate Guide

Source : www.keepertax.comDeducting Meals as a Business Expense

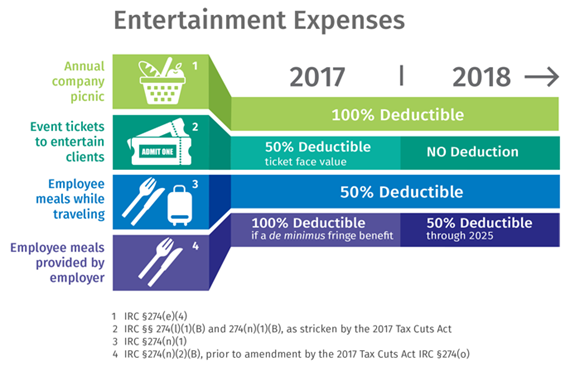

Source : www.thebalancemoney.comMeals & Entertainment Deductions for 2021 & 2022

Source : www.cainwatters.comTax Changes for Your 2023 Filing and a Brand New 2025 Reporting

Source : lslcpas.com2025 Guide to Meal and Lodging Expenses In The US Driversnote

Source : www.driversnote.com25 Small Business Tax Deductions To Know in 2025

Source : www.freshbooks.comDeductible Meals In 2025 Meal and Entertainment Deductions for 2023 2025: Reading are set to be hit with a two-point penalty deduction by the English Football League (EFL) for money owed to HMRC. The League One club have already been deducted four points this season for the . Food prices increased by 9.9% in 2022 So why aren’t more Americans feeling better? IVF may be tax deductible, but LGBTQ+ couples less likely to get write-offs ‘I could get a frozen family lasagna .

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

.svg)